Understanding Cryptocurrency Volatility Patterns

Volatility represents the degree of price variation in cryptocurrency markets. Understanding volatility patterns enables traders to optimize position sizing, select appropriate strategies, and manage risk effectively. This analysis explores cryptocurrency volatility characteristics and practical applications for futures trading.

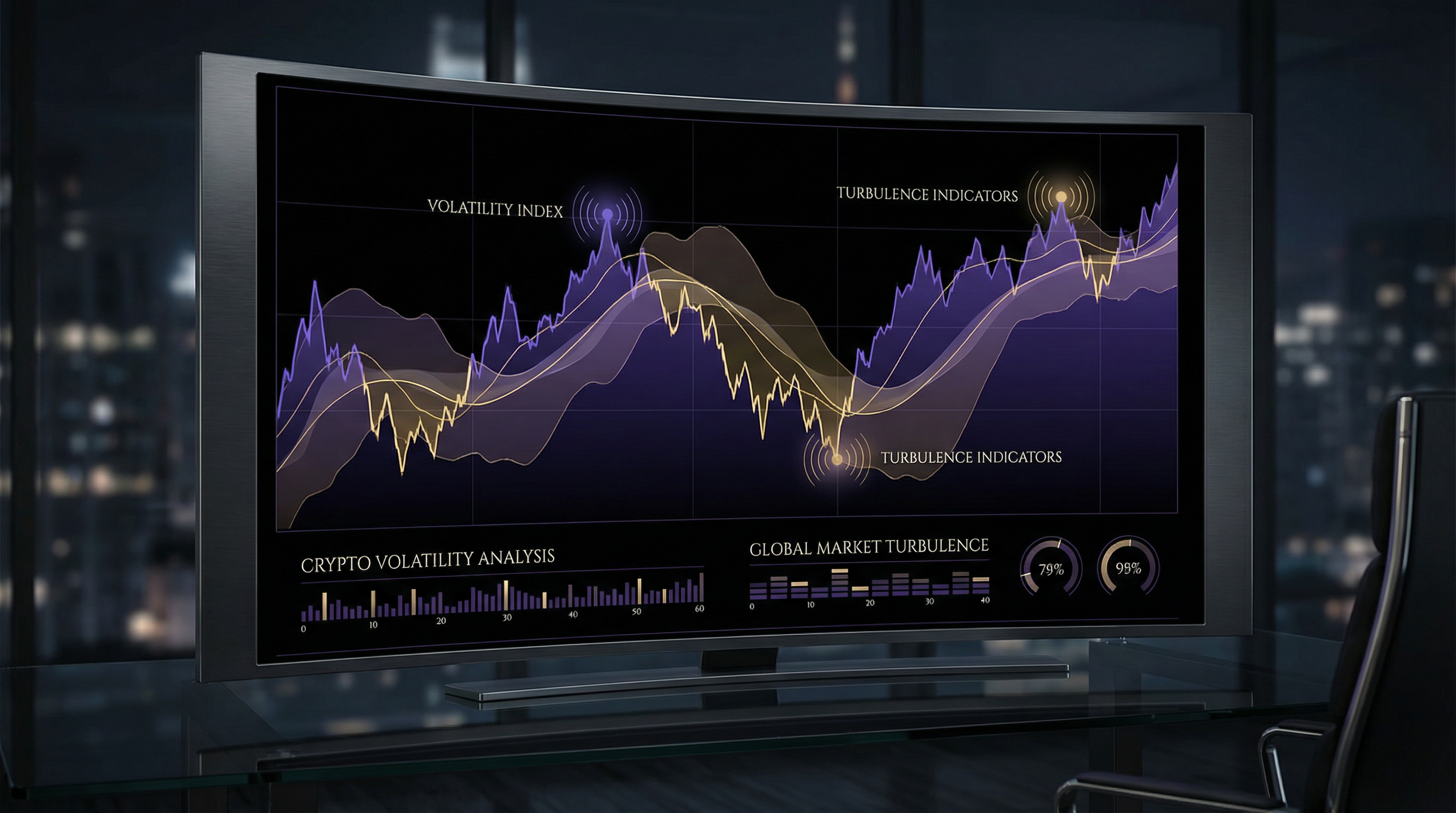

Measuring Volatility

Historical volatility measures past price fluctuations using standard deviation calculations. Calculate daily returns, compute their standard deviation, and annualize the result. Bitcoin typically exhibits 60-80% annualized volatility, significantly higher than traditional assets. Altcoins often show 100-150% volatility, reflecting their smaller market caps and lower liquidity.

Implied volatility, derived from options pricing, reflects market expectations of future volatility. When implied volatility exceeds historical volatility, options are expensive, suggesting traders anticipate increased price movement. This divergence often precedes significant market events or trend changes.

Volatility Cycles

Cryptocurrency markets experience distinct volatility cycles. Low volatility periods, characterized by tight price ranges and declining volume, often precede explosive moves. Professional traders accumulate positions during these quiet phases, anticipating the next volatility expansion. Average True Range (ATR) effectively identifies these transitions—when ATR contracts to multi-week lows, significant moves typically follow.

High volatility periods present both opportunities and risks. Price swings of 10-20% within hours create substantial profit potential but also increase liquidation risk. During these phases, reduce position sizes and widen stop-losses to accommodate larger price fluctuations while maintaining consistent risk exposure.

Trading Volatility

Volatility breakout strategies capitalize on transitions from low to high volatility. Identify consolidation patterns with declining ATR values. When price breaks the consolidation range with expanding ATR, enter positions in the breakout direction. These setups offer favorable risk-reward ratios as stops can be placed just beyond the consolidation range.

Volatility mean reversion strategies exploit extreme volatility readings. When volatility spikes to multi-month highs, it tends to revert to average levels. This doesn't necessarily mean prices reverse—volatility can decline while trends continue, but at a more moderate pace. Adjust position sizing and leverage based on current volatility levels to maintain consistent risk exposure.

Risk Management

Volatility-adjusted position sizing ensures consistent risk across varying market conditions. During high volatility periods, reduce position sizes proportionally. If normal volatility is 60% and current volatility reaches 120%, halve your position size to maintain equivalent risk. This approach prevents overleveraging during turbulent markets while allowing larger positions during stable periods.

Stop-loss placement must account for volatility. In low volatility environments, tight stops work effectively. During high volatility, widen stops to avoid premature exits from valid positions. Use ATR-based stops—placing them 2-3 times the current ATR from entry provides appropriate breathing room while maintaining defined risk parameters.

Conclusion

Volatility analysis provides crucial context for cryptocurrency futures trading. Understanding volatility cycles, measuring current volatility levels, and adjusting strategies accordingly enhances trading performance. Professional traders view volatility not as risk to avoid but as a characteristic to understand and exploit. By adapting position sizing, stop-loss placement, and strategy selection to current volatility conditions, traders maintain consistent risk exposure while capitalizing on market opportunities across all market environments.

Trade with confidence using professional volatility analysis tools